Perhaps on Mining and Related industries day and given we are meeting this year, in the Pilbara, I should share a little of the story of my time as the Chairman of our Australian private company, Hancock Prospecting, which started as a West Australian pastoral and exploration company, plus more recently, as Chair of Roy Hill also.

Despite what too many in the media inaccurately imply, Hancock Prospecting hasn’t always been the successful multibillion-dollar company it is today.

The reality was we had many, many tough years. Mistakes made prior to my Chairmanship left us with difficulties and liabilities we weren’t able to pay off for almost a decade, limiting our ability for exploration, and investment and growth.

Indeed, unable to pay all the government obligations on Roy Hill, we lost approximately half of Roy Hill.

Media wrongly refer to the assets of the company then being worth billions of dollars, confusing then with now, even wrongly referring to a trust owning a minority interest back then being worth billions of dollars, whereas what was actually there when I took over the responsibilities of Chair was a very different reality. The few remaining company assets were mortgaged to the hilt, or under legal claim or under threat of legal claim, liabilities and contingent liabilities, with cheques being written and left in drawers until the quarterly, then small, royalty cheques arrived to cover them. Even dividends payable under our company constitution hadn’t been able to be paid prior to my Chair.

Unlike many in the media chose to portray, money didn’t just spring out of the ground without years of work and effort and risk investment once a tenement is granted. Money just doesn’t fall from the sky. Canberra and the media also need to understand this.

In 2006, after years of work, Hancock Prospecting took on new debt to pay for its first Hope Downs mine in a joint venture with Rio Tinto.

And it didn’t stop there. We entered further arrangements and went further into debt for two more Hope Downs mines.

Usually, companies that take on such investments and commitments are much larger than our private company -but the banks supported me. And were paid back ahead of schedule.

Before I talk about bringing Roy Hill together, I want to go back to 1992 when we took on the Roy Hill tenements dropped by then iron ore leader BHP.

In ’92, I was the youngest in the company and had just taken on the responsibility of Chairmanship.

Against advice, HPPL applied for Roy Hill and took a huge risk on Roy Hill. Staff were saying, ‘don’t do it’. I repeat, this was in 1992, not recently as the media chose to change and wrongly report, (despite 1992 being in the written quote).

Everyone involved in our company back in 1992, and our external consultant also, thought taking on Roy Hill was the wrong decision. They advised in writing not to take up

Roy Hill.

After all, not only was the company group short of money for such undertaking, but also when the most knowledgeable company in iron ore in the Pilbara had decided that the Roy Hill area was not of value after their own initial exploration, you can understand why professional people had their reservations. But I shared my father’s vision and desire for northern development.

Fortunately for us, BHP’s exploration program hadn’t been successful, largely involving placing their drill holes in the wrong places.

After more successful exploration, we recognised that for a project like Roy Hill, to be able to support infrastructure for its tonnage over approximately 300 kilometres, a mega-project would be required. And for a project the size of Roy Hill, the banks would prefer to see us with partners of substance.

We achieved such partners, partners who, like us, took on still significant risk, given this project was mainly a greenfield project. We financed approximately 40 per cent of the project from

our partners and our own pockets, then after entering into borrowings, debt funds became available, just in the nick of time, when the project was nearly 50 per cent constructed, and about to run out of money for construction.

Our partners, Marubeni Corporation, POSCO and China Steel, also committed to be customers with over 50 per cent of Roy Hill’s 55-milliontonne output committed to them.

Our mega financing with 19 of the world’s largest banks, including the 11 largest banks in the world, and five ECAS, gained international acclaim, winning a number of financing awards. Apart from being the largest financing in mainland resource history ever, we have achieved other firsts, such as having the largest ever commercial contract between Australia and Korea.

I would like to pay tribute to our Roy Hill Shareholders, Board and the Roy Hill Executive, and our banks and ECAS, who played a major part in making this project happen. Could each of you present please stand.

So many people said we’d never be able to pull this mega-project off. .. but we have.

Roy Hill now has four large mine pits operating with their production well ahead of schedule.

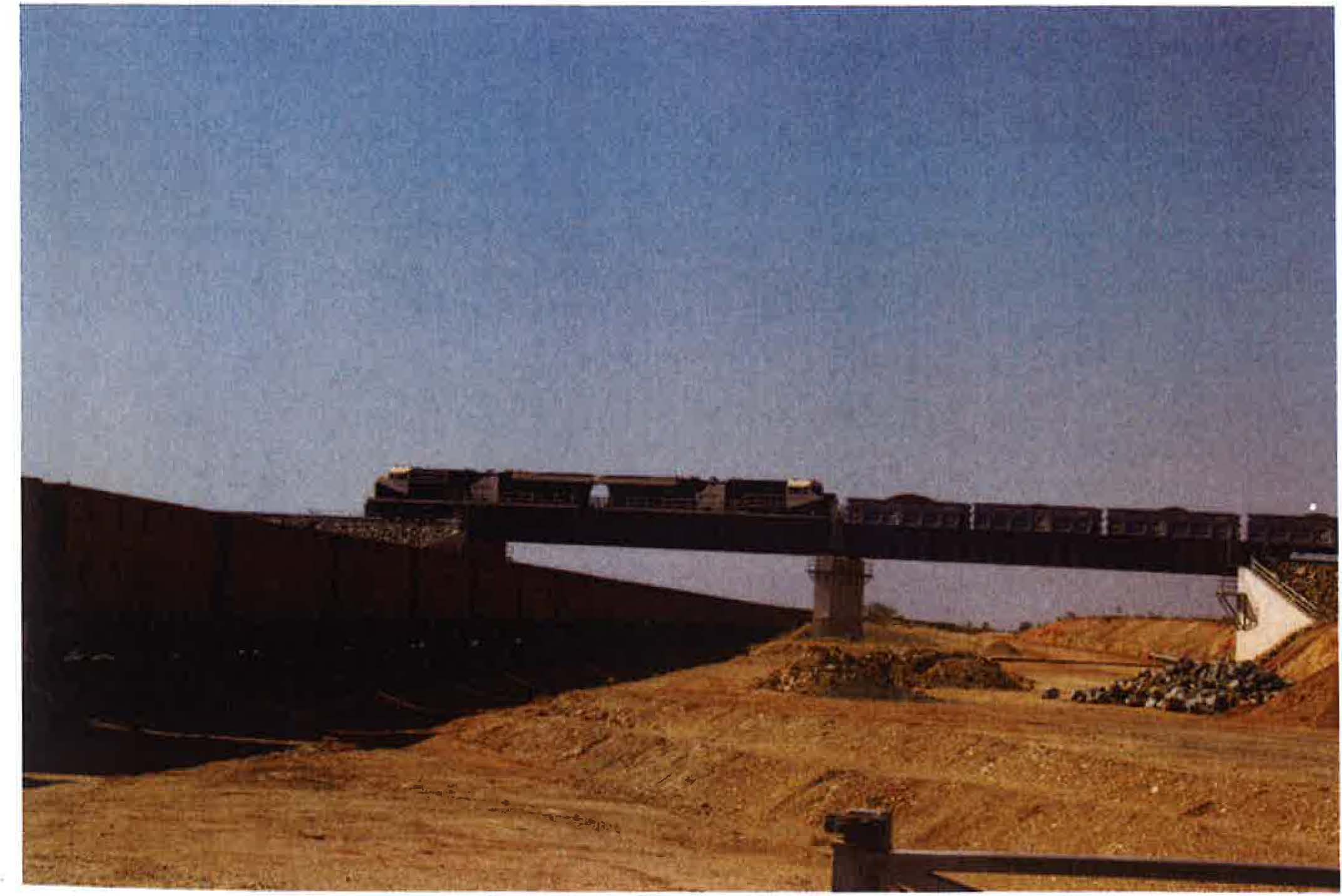

Our 344-kilometre heavy-haul railway is complete and employs the latest technologies with options for automation. We celebrated last month first ore on rail, and its delivery to Port Hedland.

Our dedicated two-berth port facility at Port Hedland is capable of exporting more than 55 million tonnes per annum of iron ore as lump and fines.

We have achieved many noteworthy firsts. First mega project in Australia to achieve 10 million ‘man hours’ without a day lost due to safety incident – not only better than the average of our competitors, but also both state and national averages.

We also have some of the largest equipment in the world, including the largest stackers in the world.

Despite some quite unfair reporting in the media at,times, our staff morale is high, and we are four months ahead of the construction schedule in the bankable feasibility study, despite unseasonal weather delays. And for the parts of the project Roy Hill built directly, this was all on time or ahead of schedule, and within budget.

Don’t believe everything you see or hear in the media. This is an amazing achievement by our executives and project team, and the 40,000 men and women who’ve been involved across the project over years.

In terms of the world iron-ore market, Roy Hill is a low-cost producer, with low phosphorous impurities, significant lump ratio and consistent quality, so we are better situated than most.

With Australia exporting record quantities of almost 800 million tonnes per annum of iron ore, quality iron ore resources are being consumed at a fast rate and it takes many years to achieve government approvals, permits and licences to enable new mines. Over time, the demand-supply situation changes.

Roy Hill is a long-term project with a long-term outlook and approximately 90 per cent of Roy Hill’s quality product is already under long-term contracts.

But Australia needs to understand that there is nothing we can do about international prices and if we don’t keep our costs down and export competitively, other nations will.

We need to do more to reduce costs and be more cost-competitive if our country is to continue to count on the revenue and benefits that mining and its related industries bring.

The major cost cutting that needs to occur is to lessen the burden government places on the mining industry, in particular in the area of regulation, approvals, permits, licences

and compliance.

Last year, at national Mining and Related Industries Day in Darwin, I spoke of the thousands of regulatory hurdles Roy Hill had faced.

This year, I’m sorry to report – the list just keeps growing. It’s a growing problem that doesn’t seem to really be recognised, but who in this room thinks that by ignoring it, it will somehow go away? Of course it won’t, we all need to speak up.

Roy Hill had to achieve more than 4000 approvals, permits and licences – and more again for construction.

So when we look today and ask where are the next mainland projects of the size of ours in the about to happen pipeline, I’m actually not surprised.

Who would put themselves through this expensive lawyer paper mill, in addition to all else necessary?

But with Australia’s budget dilemma and record government debt levels – now well over $400 billion in federal debt alone – we need mega projects like Roy Hill that will generate revenue, opportunities and jobs to maintain and or raise our living standards.

Many on the left of politics and in the media might like to see the mining industry decline, but does the rest of Australia want to go without the revenue, opportunities and living standards that the mining and related industries provide?

If the rest of Australia wants the benefits !hat the mining and related industries provide, we need to ALL speak up, and keep speaking up.

We all know what’s happening: exploration is drying up, investment is down, and Australia has become a place those overseas say, ‘Invest in Australia, why?’

Without investment, and people prepared to take the investment risk, there won’t be mega projects like Roy Hill in future, with all the consequences this would entail.

Over-regulation pushes up costs and limits opportunities. Compliance costs can be enormous and time-consuming, and the taxpayer has to pay the wages of all of that enforcement – much of it is frankly quite unnecessarily and/or counterproductive.

We should have a duty to leave to future generations of Australians a healthy and growing economy, and a duty to look after our increasing proportion of elderly people and to look after those who provide our internal and external defence – and for all that to be possible, it’s time to change our mindset.

Roy Hill should serve as a beacon of hope but Australia needs to do more to unleash the potential of our largely undeveloped North.

We need to stop finding reasons not to do things and pursue ways of making it happen. Special economic zones, working successfully in other parts of the world, could work in our North too, which is why ANDEV, Australians for Northern Development and Economic Vision, has spent years promoting these Jess government burdened zones.

We should be finding ways to entice investment and welcoming Australians investing in Australia, but what do we read in the media?

My father, Lang Hancock, through his discoveries and determination to overcome bureaucracy to enable the benefit of his discoveries, changed Australia’s fortunes.

His achievements are remarkable in that his legacy helped improve our living standards, our quality of life, and spread opportunities to so many across this country.

Not all of us can make the extraordinary contribution my father did, commencing with his historical discovery flight back on 22 November, in 1952, but. 1 hope you will join with me to stand up for the industry and related industries as he also championed, and upon which discovery date our annual Mining and Related Industries Day was founded.

My friend Jim Viets has created a song especially for Australia’s Mining and Related Industries Day. He had it recorded for us by a person who has won four Grammys. The song is sung by my fiiends Geoff Thompson and Jim Viets. Today will be the first day this is heard in Australia. We’ll also put it on our company websites. Can you please join me in thanks to these gentlemen?

Thank you so much for joining us in the Pilbara for National Mining and Related Industries Day!