Article by Cecile Lefort and Joshua Peach courtesy of Financial Review.

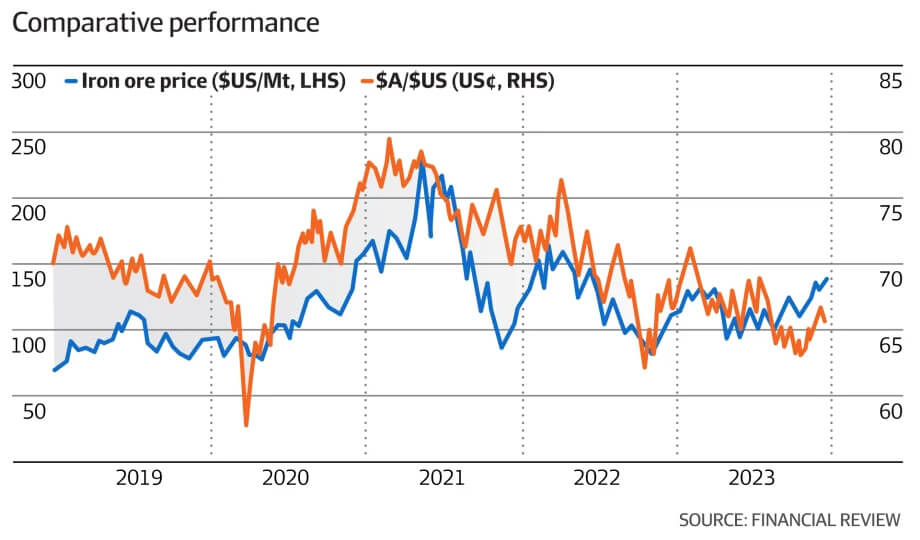

An almost 30 per cent surge in the iron ore price to above $US140 a tonne has bolstered the prospects for the Australian dollar, which economists predict could hit US70¢ by the end of the year.

That’s the median forecast for the $A from The Australian Financial Review’s quarterly survey of 37 economists and compares with its current level of about US67¢.

The local currency has jumped more than US4¢ since October, buoyed by speculation the US Federal Reserve will cut interest rates five times this year, starting as early as March.

The Reserve Bank of Australia, in contrast, is widely expected to start easing in August or September, and bond futures are fully priced for only one rate cut this year.

Nine economists out of 40 surveyed say the central bank is not done raising rates and tip an increase in the cash rate to 4.6 per cent next month because of sticky services inflation.

But an unexpected surge in the iron ore price in the second half of last year has also helped the local currency, as strong demand from China’s steel mills appeared to shrug off a weak outlook for the nation’s debt-laden property sector, which accounts for about 40 per cent of China’s steel demand.

Iron ore exports are Australia’s single largest income earner.

“Iron ore prices have proved remarkably resilient versus China’s economic woes,” said independent economist Michael Blythe at PinPoint Macro Analytics, who forecasts an average iron ore price of $US130 a tonne for 2024.

He expects Beijing to inject further stimulus into real estate and construction to bolster economic growth, limiting any “downside to iron ore prices”.

“The Australian dollar has a reasonably close correlation with iron ore prices, which is not surprising given it is a commodity currency.” He tips the Aussie to climb to US72¢ by December.

The almost 30 per cent rally in the iron ore price in 2023 made it one of the best-performing commodities of the year. The gains extended into January, pushing prices to a two-year high on optimism that China’s economic recovery is gaining momentum.

‘Not enough iron ore’

Joel Parsons, portfolio manager at Drakewood Capital Management in Singapore, said the commodity’s strength had caught many in the market by surprise.

“The iron ore market is pretty tight,” he said, adding that the lack of intervention by Chinese authorities to curb production last year had pushed prices even higher.

“It just shows that when there’s not a limit on China’s steel making, there’s not enough iron ore in the world to meet demand.”

Mr Parsons said that while prices had dropped recently – falling more than $US5 since last Wednesday to trade around $US137.20 a tonne in Singapore – iron ore was broadly trending higher, buoyed by comments from Chinese President Xi Jinping late last year in which he said that Beijing would “consolidate and strengthen” the economic recovery.

“When you look at comments like those … it’s hard to feel that China is on the verge of collapse,” Mr Parsons said.

“The likelihood is that the steel mills will keep producing until the government stops them.”

Economists, however, are more divided on the outlook for Chinese demand, and expect iron ore to slip back to $US105 per tonne this year, according to the Financial Review’s survey of 25 economists.

Forecasts vary widely, from as low as $US77 a tonne to almost double that at $US150. The average value of the steel-making ingredient in the past decade stands at $US97 a tonne.

Goldman Sachs predicts the iron ore price will top $US130 by March, and the average value over 2024 to slip to $US110, from $US117 last year.

“While China’s steel demand remained in clear contraction, the feed-through into iron ore demand has been limited by outperforming steel production,” said Andrew Boak, chief economist at Goldman Sachs Australia.

“Resilient iron ore prices will support the $A, which we expect to appreciate to US72¢ on a 12-month view.”

Commonwealth Bank currency strategy Carol Kong, meanwhile, believes the iron ore market is too optimistic about Chinese steel demand, and is tipping the price to hit $US90 by the end of 2024.

The slump, she said, would initially weigh on the local dollar before it bounces to US72¢ as the global economy recovers from lower interest rates.

Decoupling

Tribeca Investment Partners’ Todd Warren said while the lead-up to Chinese new year typically brought seasonal strength to prices, steel production had begun to “roll off” as producers’ margins contracted.

“We don’t see a dramatic collapse in prices, but I think the good times have probably been had in the immediate term,” he said.

As for what this means for the $A, economists noted a marked deterioration in the historical link between the Australian dollar and commodity prices. The Reserve Bank’s index of commodity export prices shed 11 per cent last year, due to lower thermal coal and liquefied natural gas prices, yet the local currency held steady.

“The relationship between AUD/USD and commodity prices has weakened over the past couple of years as commodity prices have been negatively correlated with equity prices,” said Ben Jarman, chief economist at JPMorgan in Australia. He predicts the local dollar to end the year at US69¢.

IFM Investors chief economist Alex Joiner forecasts iron ore prices to ease to $US100, which he, too, said would have a “minimal impact” on the local currency because it had decoupled in favour of interest rate differentials between the US and Australia.

“On that basis, we expect the Australian dollar moving towards US70¢ as the Fed becomes more dovish and eases rates well before the Reserve Bank.”

Tim Toohey, head of macro and strategy at Yarra Capital Management, agrees.

He said that while the iron ore price would likely average around $US120 in 2024 and “remain supportive of the terms of trade remaining at a high level”, the real catalyst for the currency would be deeper rate cuts in the US and a weaker greenback that would propel the Aussie to US75¢ by the end of 2024.