Article by Peter Ker and Brad Thompson courtesy of the Australian Financial Review

Australia’s richest person, Gina Rinehart, has agreed to soothe the pain that record iron ore prices are inflicting on the Asian steel mills of her partners in the Roy Hill mine by declaring a monster $1.35 billion dividend for the first three months of the year.

The extraordinary payout was requested by Korean steel giant and Roy Hill shareholder POSCO and was worth almost $1 billion to the Rinehart companies that control 70 per cent of the West Australian mine.

But amid the euphoria of record prices for Australia’s most lucrative export commodity, Roy Hill warned that the bumper prices would not last as rival nations would soon bring new supply into the market.

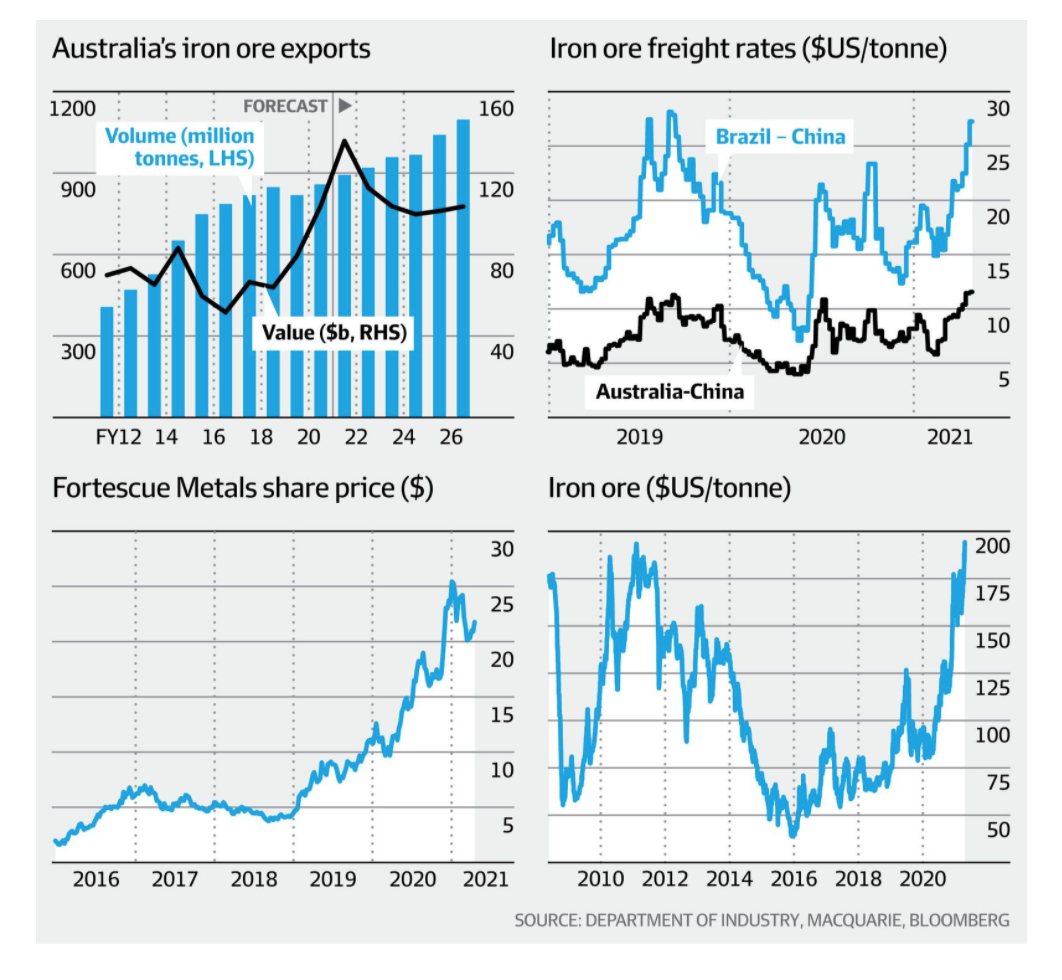

Iron ore price providers such as S&P Global Platts and Fastmarkets MB declared a new record price for “benchmark” ore with 62 per cent iron on Tuesday night, with S&P putting the price at $US193.85 a tonne and Fastmarkets reporting the price at $US195.31 a tonne.

The profitability of Australian miners has been further buoyed by the fact unit costs of production are much lower than when the previous record was set in February 2011, thanks to economies of scale and a weaker Australian dollar.

The Brazilian miner whose weak output since January 2019 has played a major role in the price rally, Vale, said it did not expect Chinese steel makers’ record-breaking demand for iron ore to ease in the next few months.

“We have the scenario of a fantastic demand coming,” Vale’s ferrous minerals boss Marcello Spinelli said on Wednesday.

“We’re going to face a stronger demand the next quarter.”

The record iron ore price is a huge boost for the federal Treasury – which has banked on a price of $US55 a tonne excluding freight – but is particularly sweet for Mrs Rinehart after many analysts questioned her 2014 decision to use $US7.2 billion of debt to build Roy Hill’s mine and railway amid soft iron ore prices.

When iron ore prices slumped to $US87 a tonne in late 2012, Credit Suisse analysts said the Roy Hill proposal was “looking shaky” and had “missed out on the window of opportunity” for high iron ore prices.

But stronger than expected iron ore prices over the past two years have allowed Roy Hill to clear its debt and, like Andrew Forrest’s Fortescue Metals Group, the company has pivoted to rewarding its shareholders with huge, fully-franked dividends.

The $1.35 billion dividend declared at a Roy Hill board meeting on March 25 was understood to be about 75 per cent of Roy Hill’s operating income for the quarter, suggesting the company is on track to smash its record $2.2 billion profit set in fiscal 2020.

The first quarter dividend almost tripled the maiden $475 million dividend declared by Roy Hill in September.

POSCO sought a reward for shareholders

Korean steel maker POSCO owns 12.5 per cent of Roy Hill and gets about 25 per cent of the iron ore for its Asian steel mills from the mine – the equivalent of about 15 million tonnes a year.

POSCO said in a statement it had asked Roy Hill to reward shareholders sooner rather than later amid the high cost of buying iron ore.

“POSCO, burdened by rising iron ore prices, asked Roy Hill for the largest dividend in the first quarter, and Hancock, the largest shareholder, accepted it positively and confirmed the dividend amount more than doubled from the previous quarter,” the Korean steel maker said.

The dividend was paid to Roy Hill shareholders in April.

Japan’s Marubeni owns 15 per cent of Roy Hill and Taiwan’s China Steel Corporation has 2.5 per cent.

With no debt liabilities we are now in a strong position, enabling us to reinvest in the business and explore growth opportunities.

— Roy Hill spokesman

A spokesman for Roy Hill said governments should avoid the temptation to introduce new taxes and cost burdens on the industry amid record iron ore prices, given rival nations would soon drag down prices with new supply.

“The high iron ore price won’t last, given other lower cost countries with huge resources, and huge higher grade resources, will come into production in future,” the spokesman said. “The governments need to understand this and not be tempted to backdate tax regimes.

“We have seen throughout COVID-19 just how important the iron ore and mining industry is to our state and nation. It’s essential not to kill the goose that lays the golden eggs.”

The spokesman said Mrs Rinehart had seen lean times in the resources industry and so had been determined to clear Roy Hill’s debt as soon as possible.

Gina Rinehart has seen lean times in the resources industry, a Roy Hill spokesman said.

“With decades in the business Mrs Rinehart has seen decades where the real price of iron ore has not increased, with ore price predictors constantly wrong and many years of price movements up and down,” he said.

“She has also seen years of very high interest which, inter alia, reduced her family company so significantly that cheques were being written and put in drawers when she arrived as chair as there wasn’t money in the bank to send them.

“She has hence wanted to safeguard her businesses as much as possible and reduce debt early.

“With no debt liabilities we are now in a strong position, enabling us to reinvest in the business and explore growth opportunities.”

Aside from high iron ore prices, Asian steel makers are also contending with high shipping costs amid a global economic recovery and a commodities boom.

S&P Global Platts said the cost of shipping iron ore from WA to China in a capesize vessel had risen to $US12.50 a tonne on April 27 – the highest price since December 2013 and well above last year’s average freight cost of $US6.63.

Rio Tinto said last week it includes the cost of freight in about 71 per cent of iron ore sales from WA.

Freight costs for Vale’s Brazilian iron ore surged as high as $US28 a tonne earlier this year amid hot competition for vessels from South America’s soybean industry.

Roy Hill was initially built to export 55 million tonnes a year, but disclosures by all other Port Hedland exporters suggest Roy Hill shipped closer to 63 million tonnes in fiscal 2020.

Port data published by Macquarie this week suggests Roy Hill has been shipping at annualised rates of above 60 million tonnes in four of the past five months, with export rates rising as high as 69 million tonnes a year in March.

Fortescue will update investors on its export performance on Thursday, with Macquarie analysts expecting the miner to report shipments of 42.2 million tonnes for the first three months of 2021.

If that forecast is correct, then Fortescue will be on track to beat the record export tally it set in fiscal 2020 at 178.2 million tonnes.

If Fortescue can match the 47.3 million tonnes it shipped in last year’s June quarter, the company will have shipped just over 180 million tonnes in fiscal 2021.

Fortescue began fiscal 2021 with a promise to ship between 175 million and 180 million tonnes of iron ore from WA, but raised that target to between 178 million and 182 million tonnes in February after making a fast start to the year.

Export data published by BHP last week suggested it too was within striking distance of beating its full year export target, highlighting how Australian miners are seizing on the opportunity to make big profits amid the iron ore price boom.

Roy Hill is not the only WA iron ore project POSCO bought a stake in to reduce its exposure to the oligopolistic nature of the iron ore industry.

API’s iron ore in the West Pilbara is located close to Rio Tinto’s Robe River operations.

It is also a shareholder in the dormant Australian Premium Iron joint venture with China’s Baowu, Aurizon and US company AMCI, which may yet be revived under a smaller model that shares transport infrastructure with incumbent iron ore exporters in WA.

Federal Resources Minister Keith Pitt said iron ore was helping the Australian economy to rebound from last year’s coronavirus lockdowns.

“Iron ore remains our single largest commodity export and it is forecast to earn Australia around $700 billion from this financial year to 2025-26,” Mr Pitt said. “Iron ore supports 45,600 direct Australian jobs.”